Today I have the pleasure of interviewing Brigitte A. Thompson about her wonderful guide Bookkeeping Basics for Freelance Writers. Brigitte is the founder and President of Datamaster Accounting Services, LLC. She has been active in the field of accounting since 1986 and is a member of the American Institute of Professional Bookkeepers and the Vermont Tax Practitioners Association.

Today I have the pleasure of interviewing Brigitte A. Thompson about her wonderful guide Bookkeeping Basics for Freelance Writers. Brigitte is the founder and President of Datamaster Accounting Services, LLC. She has been active in the field of accounting since 1986 and is a member of the American Institute of Professional Bookkeepers and the Vermont Tax Practitioners Association.A prolific writer, Brigitte is the author of several business books, contributing author and freelance writer specializing in accounting topics. Her business has been featured in a best-selling book by Paul & Sarah Edwards, The Entrepreneurial Parent, and in Mompreneurs Online by Patricia Cobe & Ellen Parlapiano.

Brigitte lives in the Green Mountains of Vermont with her husband and three children.

Tell us about Bookkeeping Basics for Freelance Writers.

Writers have many important questions to ask about income and expenses, but no single source for answers. I created this book to be that source. It is an easy-to-understand guide to organizing a writer’s financial life.

This book addresses issues writers face daily such as how to deduct travel expenses, determine taxable writing income, and claim home office deductions. Navigating through the record keeping required for a small business owner can be difficult. This book is written exclusively for those of us who earn money by writing.

Readers will also find that each part of this book works together to assist in forming an overall business plan. The chapters take the writer through a comprehensive process that works as a building block towards a successful writing business.

Have you found that freelance writers require a different set of bookkeeping rules?

Many bookkeeping rules are universal such as the requirement to record income, but there are some areas of the tax law that are of more interest to freelance writers. This includes dealing with royalty payments, bartering, personal property and agent fees. My book addresses the universal tax rules as well as the infrequently discussed rules that apply specifically to freelance writers.

Learning how to document expenses and how to track income will give writers the best chance at overall business success.

What are some tax deductions that freelance writers might not be aware of?

There are many tax deductions available to writers. Some expenses are common, such as the cost of purchasing a case of paper or paying for a computer software upgrade. Other costs incurred in the operation of your writing business may not jump out at you as expenses when they could be. For example, consider the following accounts.

Mileage: Trips made in your vehicle to pick up office supplies can be counted as a business deduction if you record the proper information to support it.

Meals: Treating your agent to a restaurant meal with the discussion focusing on your next book can also generate a tax deduction when properly documented.

Shipping: UPS charges and postage used to mail a query or review copy of your book can be a small expense, but it should still be tracked. Those small deductions add up and every penny spent as a qualified business expense will reduce the amount of income tax you owe.

Bookkeeping Basics for Freelance Writers devotes an entire chapter to expenses, including a comprehensive listing of expenses and detailed information regarding what documentation is required to support each one.

I'm sure you've observed other freelance writers making accounting missteps that cost them time and money. What are some of the most common issues and how can we avoid them?

The most common misstep I’ve seen with writers is not taking themselves seriously as business owners. This can lead to financial pitfalls. Many writers have been honing their craft for years so it’s hard to identify an official starting date for their self-employment. Without this point to mark the beginning, it is easy to put off tracking income and expenses. This can be an unfortunate mistake.

The IRS will consider you to be in business when you are actively pursuing projects intended to generate income and expenses. This means they will expect you to file a tax return to report those transactions. Keeping track of your income and expenses from day one will enable you to pay the least amount of income taxes on the money you earn.

Many people find numbers, especially when related to bookkeeping and taxes, intimidating. Will this book make these things easier to understand?

Yes, my book breaks down complicated number crunching into easy to follow steps. By reading the book, readers will understand why it's important to keep certain receipts and how those pieces of paper factor into the overall success of their writing business. Sometimes knowing the reasoning behind a task makes it easier to complete.

Writers can take advantage of some wonderful tax deductions, but only when they are aware of the possibility and know how to accurately document the expenses. My book explains it all in a reader friendly format.

Why is it important for writers to understand bookkeeping?

Writers are earning money and this money needs to be reported as income on their income tax return. If writers do not have any expenses to claim, their taxable income will be higher and they will owe more income tax.

Understanding what can be claimed as business expenses when you are a writer and how to properly document these expenses will help ensure the success of your business.

The most important thing you can do as a writer is to become organized. There are many books available on how to organize your writing, but this is the best book available about how to organize the financial side of your writing business.

Obviously, your book is a great place for writers to get information on bookkeeping. Are there are any other resources you recommend?

Yes, I recommend writers visit the IRS web site (www.irs.gov) to research specific tax issues and the Small Business Administration (www.sbaonline.sba.gov) for general business information.

I also recommend joining professional associations for writers such as American Society of Journalists and Authors (www.asja.org), The Authors Guild (www.authorsguild.org) and National Writers Union (www.nwu.org). There are many groups to choose from so consider the benefits of membership before joining.

I was interviewed recently by Freelance Success (http://www.FreelanceSuccess.com) which offers an insightful newsletter for their members. There are also online groups for writers such as MomWriters (http://www.MomWriters.com) offering networking opportunities as well as camaraderie.

How can we purchase your book?

Bookkeeping Basics for Freelance Writers is available through Amazon.com and my publisher (www.CrystalPress.org). Any local bookstore can order my book by ISBN-10: 0963212389 or ISBN-13: 978-0963212382. List price is $17.95.

Thank you so much Brigitte for joining us today!

Visit Brigitte's "Writers in Business" blog: http://www.writersinbusiness.blogspot.com

Her website, Bookkeeping for Writers, is: http://www.bookkeepingforwriters.com

Tomorrow, June 17th, the VBT-Writers On The Move June Tour continues with Maggie Ball featuring Mayra Calvani!

31 comments:

Very cogent points about writers not taking themselves seriously as business people. You're right, it's hard to identify the point where becoming a business owner starts. Excellent interview.

It's good to know that there's a practical good on this topic. Thanks for the great interview!

Excellent and informative interview! Brigitte, you put the dreary (for me!) financial stuff in easy, informative terms. Thanks for that!

Great information. As a former accountant I so amiss in taking the time to document all my expenses, and income.

I have two questions for you:

1. As a freelance business, with no legal business status, can you hire and pay other workers (subcontract/hire-out)?

If you do subcontract (pay other writers) do you need to have a legal business status, such as sole-proprietor?

Brigette, I'll be getting your book soon. I wait until I'm ordering a few books at one time so I get free shipping. :)

Nancy, Even with my tax background, when I began writing it was hard to pinpoint a specific date. It was a gradual process. When I was interviewing other authors for this book, it was reassrring to know I was not alone.

Thanks for visiting Mayra. I also post tax tips for writers on my blog http://www.writersinbusiness@blogspot.com and on Twitter at TaxTips4Writers.

Darcia, I appreciate your comments. Many people find the number crunching boring, but I tap into my creative side when writing these books. My goal is to convey the important information, but not put the reader to sleep :)

Thank you for visiting Karen. Those are great questions!

As far as legal status, the IRS default classification for a single taxpayer earning money through self-employment is Sole Proprietor.

You can work with others and deduct their fees as business expenses provided their service is a normal and necessary expense for your line of work. Classifying that person as an independent contractor or employee is important.

The IRS has strict guidelines on how to make this determination. You can find more by visiting the News page of my accounting web site http://www.DatamasterAccounting.com . There is a link here which will take you to the IRS web site article about this.

Also, if you do hire an independent contractor, be sure to complete a contract clearly stating expectations. There is a sample contract in my book for this purpose.

It’s a difficult task for me to make money simply off the sales of my books so these tips and others found in the book were certainly helpful.

What a great book. I'm an ex-buyer so numbers don't scare me, but I know many writers have no clue where to start or hate even thinking about crunching numbers.

However, with all that said, I'm going to pick your book up just in case there is a tax break I don't know about.

Thanks so much for sharing all these great points.

I really do need to get this book.

Such a pleasure to have you on the blog today, Brigitte! You have so much great info to share!

Bookkeeping. Ugh. I thought when I became a writer, I could stop bookkeeping. WRONG. Add marketer, sales person, production and a half dozen other roles I've got to fill and writing is one of my last tasks.

Blessings,

J. Aday Kennedy

The Differently-Abled Writer

Children's picture Book Klutzy Kantor

Coming Soon Marta Gargantuan Wings

.

Jane,

Thank you for visiting the blog and sharing your thoughts. I'm glad to read you found the tips helpful.

Thanks Virginia. There are many tax deductions available for writers. We just have to know they exist and maintain the proper records in order to take them as expenses.

Vivian, The book can help you with organizing your financial life and help you stay on top of the recordkeeping required as a writer. Thanks for visiting today :)

You are absolutely right Jessica. As writers, we wear so many hats. With all we juggle, bookkeeping is often at the bottom of the priority list.

However, understanding the available tax deductions and following the recordkeeping guidelines really can reduce your tax bill.

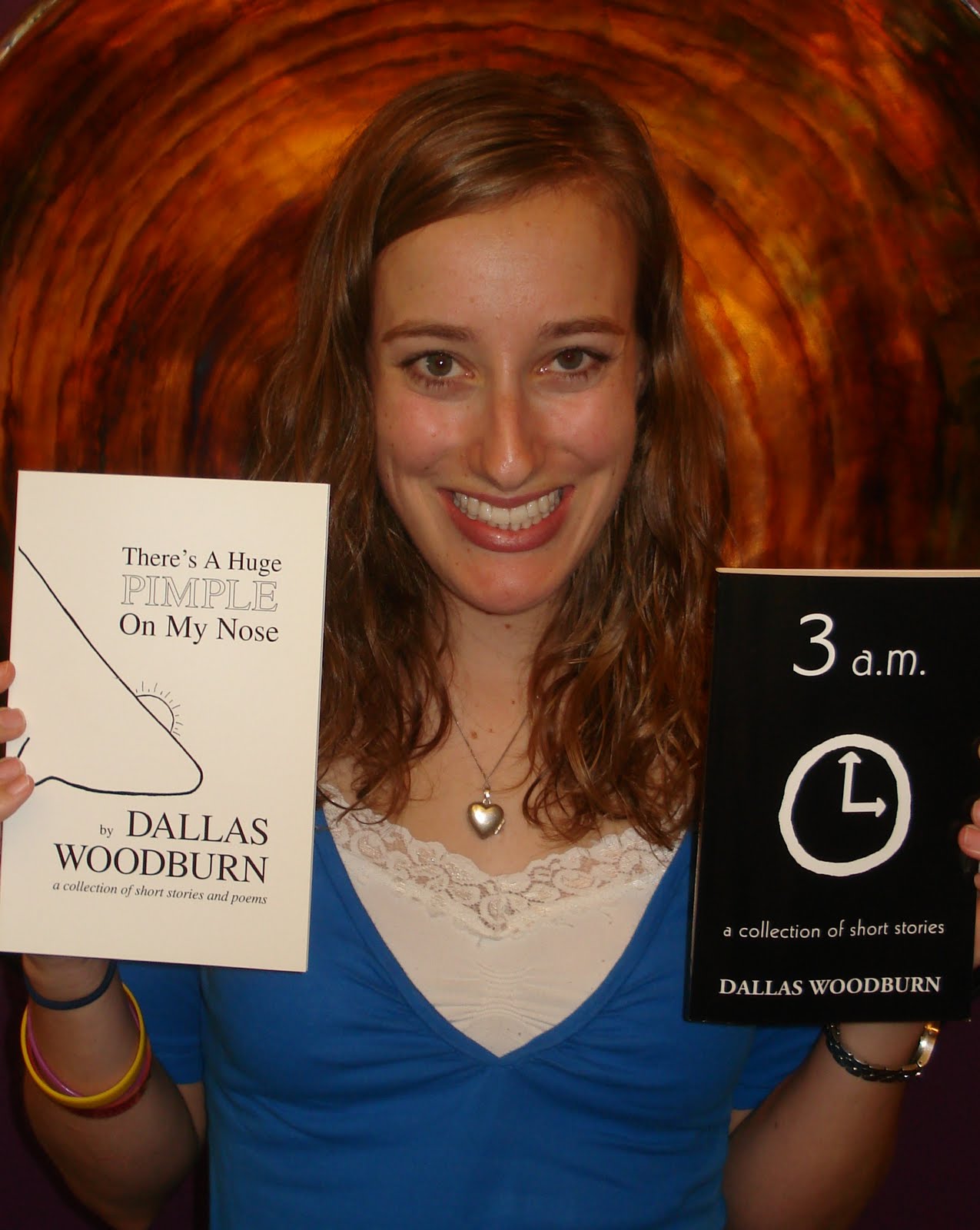

Dallas,

Thank you so much for hosting me today. You have a great blog and I've added it to my web site.

I'll be checking back for the next few days and address any questions or comments posted.

Thanks again,

As a writer I'm a word person, not a number person and the business side of the job has always been intimidating to me. This book sounds like it would help a lot.

Great interview. Do you recommend using this for folks who only do a minimal freelancing, but mostly expenses related to writing a book? I'd like to know this before I order the book. Thanks!

It sometimes comes as sad news to writers but we are in business and we do sell a product. One day Brigitte and I are going to partner on a deal. Her business book for writers, my marketing book for writers. (-: What a packet that would be!

Best,

Carolyn Howard-Johnson

Author of the multi award-winning Howtodoitfrugally series of books for writers, www.budurl.com/FrugalBkPromo

Hi Janet,

Numbers can be intimidating, but they don't have to be. There are many tips included in my book to make the recordkeeping easier to deal with. One suggestion is to break things down into smaller parts.

- Learn what you can deduct (there are lots of expenses writers may not be aware of)

- Learn the recordkeeping required by the IRS in order to claim these deductions

- Set up a routine or system that is comfortable for you to follow

- Put your plan into action :)

Thanks for visiting Katie - and for asking a question.

The book will help anyone who works with words including authors, freelance writers, web site content creators, and editors. The expenses can apply to most people in this profession.

As long as you are earning money related to writing, you can benefit from the organizational tips, recordkeeping, fill-in forms and tax information contained in my book.

There are a few reviews up at Amazon from readers who share thoughts about the book. I'd also be happy to send you an excerpt from the book, if that would help. Just let me know.

Thanks again for visiting today :)

Carolyn,

That's a great idea! I would love to partner with you to help writers with their marketing and recordkeeping. With our two books in hand, writers will be well on their way to success :)

Great tips on the practical and business aspects of writing! Useful post; thanks for sharing.

thanks for a great post ladies. I love the hint about deducting for lunch when talking about future books. does my husband count?? LOL

Mohamed,

Thank you for visiting. I'm happy to read you found the post useful.

Kathy,

Lunch is a great expense for writers as long as the purpose is related to your writing.

Lunch with your husband though.... hmmm..... If he was an employee, it would work :)

Dallas,

This is a great interview and very informative. I definitely admit that I much prefer to write than to do the bookkeeping side of the business. This was a very useful read. :-) Thanks for presenting it, and thanks to Brigitte for sharing words of wisdom.

Thanks for visiting Jennifer :) I'm glad you found the information to be useful.

Thank you for share your story. I started my freelance career in 2014 at Upwork. Till now I'm a full-time freelancer. I was very imprecise to read this blog see now Upwork Saved My Life. I think it would help to start new freelancer career.

Post a Comment